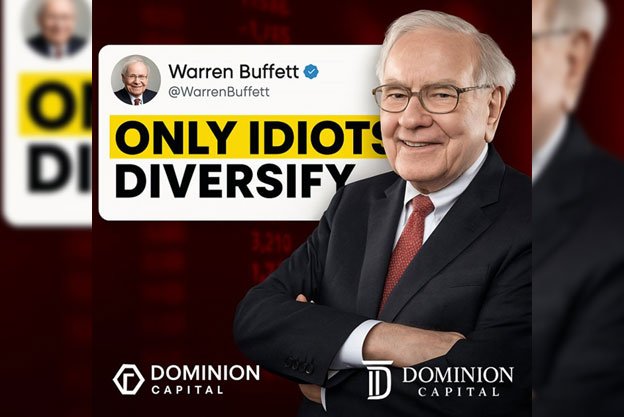

Warren Buffett once said: “Diversification is for idiots.”

Shocking? Here’s what he really meant…

When Warren Buffett says “diversification is for idiots” (he sometimes phrases it as “diversification makes very little sense for those who know what they’re doing”), he’s not rejecting diversification entirely. Here’s what he means:

1. For the average investor

Diversification — spreading your money across many stocks, sectors, or funds — is smart. It protects you if one company or industry fails. That’s why Buffett often recommends index funds for most people: they give automatic diversification.

2. For skilled investors

Buffett’s point is that if you truly understand a business and have high conviction in it, you don’t need 50 different investments. Owning too many dilutes your best ideas and limits your upside. Instead, concentrate on a few businesses you deeply understand and believe in.

3. Underlying principle

• Diversification = protection against ignorance.

• Concentration = reward for knowledge.

So, when Buffett says it’s “for idiots,” he’s speaking to professional investors who should know what they’re doing — not to ordinary savers. For most people, diversification is still the safest path.

👉 In short:

• If you don’t want to study businesses deeply → diversify.

• If you really know what you’re doing → concentrate.

📌 Follow me for grounded insights on Africa’s real economy & global breakthroughs: https://lnkd.in/gjnhA-n